Learning Platform on NGO Governance and Management:

Pro bono Consultation Service on NGO Tax Issues cum Kickoff Meeting was held with success on 5 February 2024.

The Inland Revenue Department (IRD) has updated the procedures on application for recognition of tax exemption status under section 88 of the Inland Revenue Ordinance (S88 of IRO) and has updated the Tax Guide for Charitable Institutions and Trusts of a Public Character in June 2023.

To further support our agency members in handling tax-related matters to comply with the updated tax law, the Council has collaborated with the EY Tax Controversy Services Team again to offer pro bono consultation sessions. The service will be provided through individual consultations across various areas, including:

- Regular review by the IRD

- Trading or carrying on business

- Business income

- Rental income

- Return on investment

- Disposal of a property

- Tax compliance obligations

Prior to the official commencement of the consultation, the Learning Platform on NGO Governance and Management organized a preliminary consultation session and kickoff meeting on 5 February 2024. Representatives of broad members or senior management from participating NGOs were invited to attend. During the meeting, Mr. Wilson Cheng, the Partner, Tax Leader for EY Hong Kong and Macau, provided a comprehensive explanation about the scope of the pro bono consultation service, conducted preliminary consultations, and signed confidentiality agreements with respective organizations.

Photos from the Pro bono Consultation Service on NGO Tax Issues cum Kickoff Meeting:

|

16 participating organizations were invited to attend the pro bono consultation service on NGO tax issues cum kickoff meeting. |

|||

|

Mr. Wilson Cheng, the Partner, Tax Leader for EY Hong Kong and Macau, explained the details of the service to the NGOs’ representatives and conducted preliminary consultations. |

|||

|

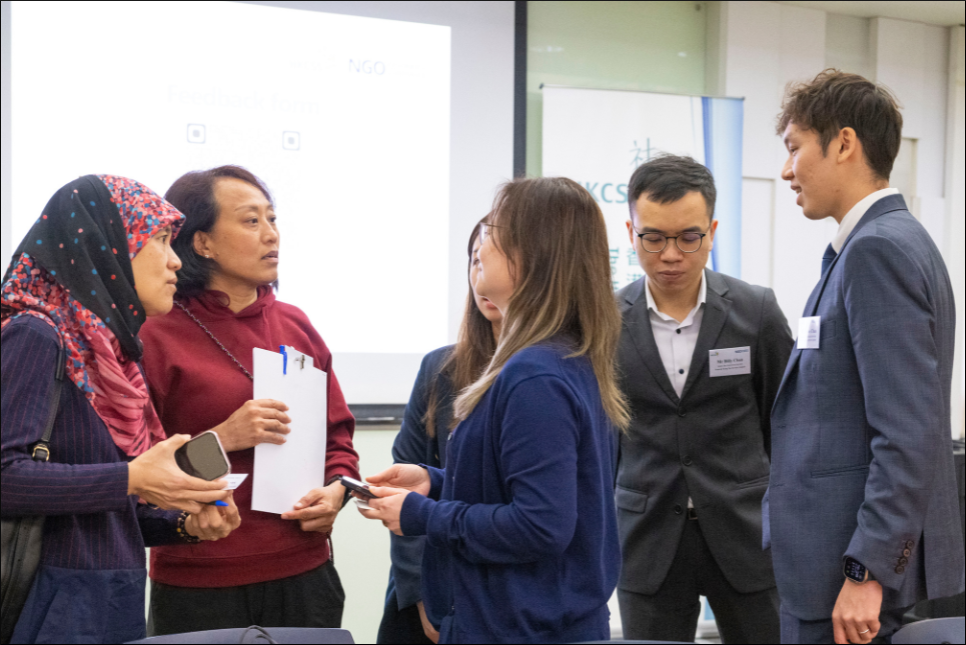

A designated networking period followed the consultation session to facilitate understanding among the participants. |

|||

|

|

The representatives from different NGOs raised tax-related questions and sought advice from EY Hong Kong. |

|||

|

Participating NGOs took this opportunity to network and engage in mutual exchange. |